IA WFD 65-5300 2012-2024 free printable template

Show details

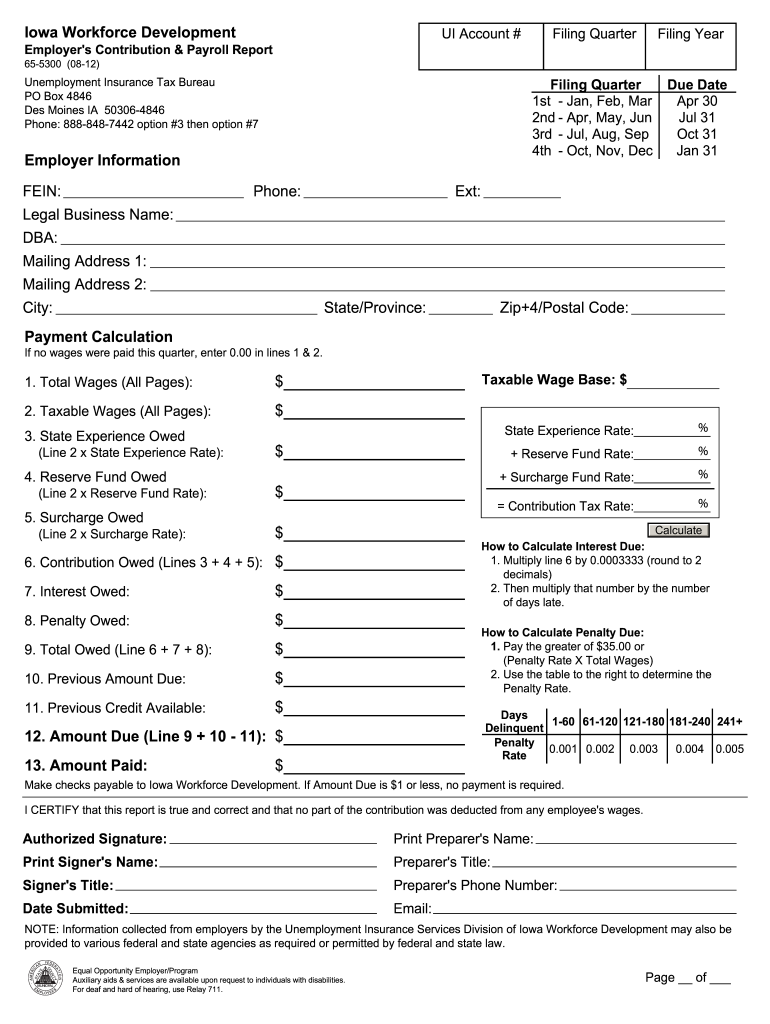

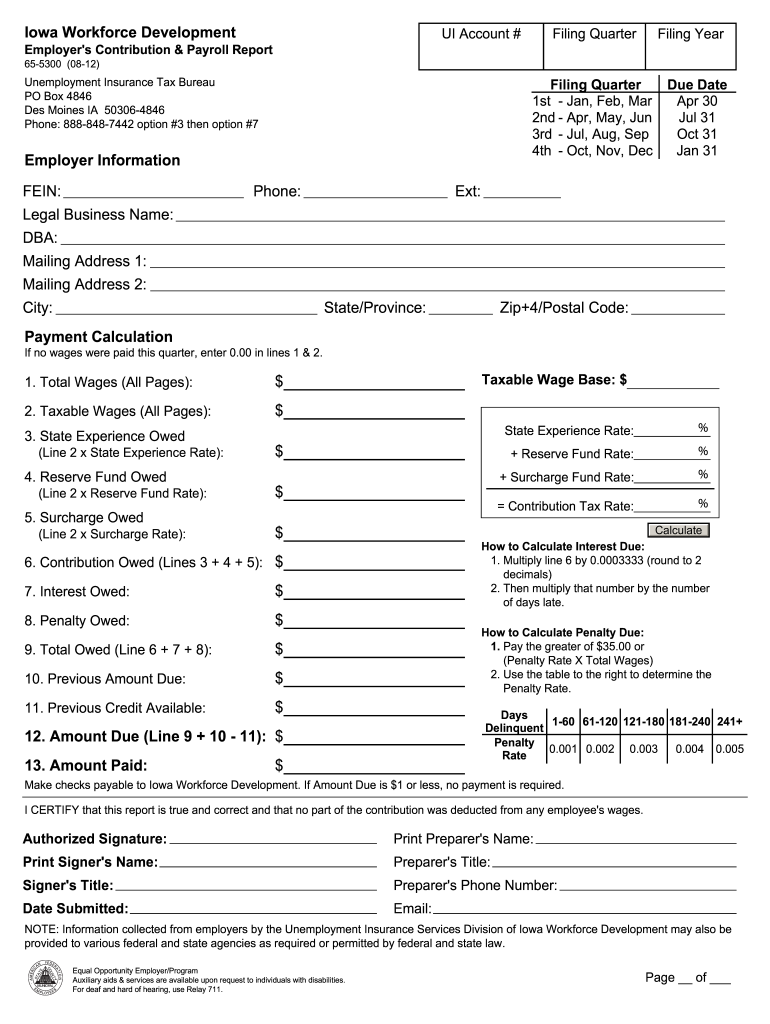

Iowa Workforce Development UI Account Employer s Contribution Payroll Report Filing Quarter Filing Year 65-5300 08-12 Unemployment Insurance Tax Bureau PO Box 4846 Des Moines IA 50306-4846 Phone 888-848-7442 option 3 then option 7 1st - Jan Feb Mar 2nd - Apr May Jun 3rd - Jul Aug Sep 4th - Oct Nov Dec Employer Information FEIN Legal Business Name DBA Mailing Address 1 City Phone Due Date Apr 30 Jul 31 Oct 31 Jan 31 Ext State/Province Zip 4/Postal Code Payment Calculation If no wages were paid...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ia 65 5300 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ia 65 5300 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ia 65 5300 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 65 5300. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out ia 65 5300 form

How to fill out ia 65 5300:

01

Gather all necessary information and documentation required to complete the form.

02

Start by entering the basic information of the individual or organization filling out the form.

03

Follow the instructions provided on the form to provide accurate and complete information in each section.

04

Double-check all entries for errors or missing information.

05

Sign and date the form as required.

Who needs ia 65 5300:

01

Individuals or organizations involved in a specific process or transaction that requires the completion of ia 65 5300.

02

Anyone who needs to provide certain information in a standardized format or document.

03

People or entities who are required to submit the form as part of regulatory or legal compliance.

Fill 65 5300 form : Try Risk Free

People Also Ask about ia 65 5300

How long do you have to work for a company to get unemployment in Iowa?

What disqualifies you from unemployment in Iowa?

What is the wage base for unemployment in Iowa 2023?

What is considered misconduct for unemployment in Iowa?

How is unemployment determined in Iowa?

Can I get unemployment if I was fired for being absent Iowa?

Who is eligible for unemployment in Iowa?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out ia 65 5300?

The IA 65 5300 form is an Iowa State tax form for individuals who are filing as a nonresident or part-year resident of Iowa, and who are claiming credits for taxes paid to other states.

To complete the IA 65 5300 form:

1. Enter your full name and Social Security number at the top of the form.

2. Enter your Iowa address and the address where you received income from other states in the appropriate spaces.

3. In Section A, enter the total amount of taxable income you received from other states during the year.

4. In Section B, enter the total amount of taxes paid to other states.

5. In Section C, enter the amount of credit you are claiming.

6. In Section D, enter the total amount of income tax withheld from wages or salaries from other states.

7. In Section E, enter the total amount of estimated tax payments you made to other states.

8. In Section F, enter the total amount of income tax imposed by other states that you paid in a prior year that has not been credited or refunded.

9. Sign and date the form and attach any supporting documents.

10. Submit the form and any supporting documents to the Iowa Department of Revenue.

When is the deadline to file ia 65 5300 in 2023?

The deadline to file Form IA 65 5300 in 2023 is April 30, 2023.

Who is required to file ia 65 5300?

IRS Form 65-5300 is typically required to be filed by employers who offer a group-term life insurance plan to their employees. The form is used to report the total cost of the group-term life insurance coverage provided to each employee, which is then considered as taxable income to the employee.

What is the purpose of ia 65 5300?

IA 65-5300 is a specific aircraft model known as the Aero Commander 500. The purpose of the IA 65-5300 is to serve as a multi-purpose utility aircraft for different aviation requirements. It can be used for various purposes such as executive transport, freight transport, air ambulance services, surveillance, and reconnaissance. Its versatile design allows it to be adapted for different missions, making it a popular choice for both civilian and military applications.

What information must be reported on ia 65 5300?

Form IA 65 5300 is the Hedge Fund Quarterly Report, which is required to be filed by all investment advisers registered with the Securities and Exchange Commission (SEC) who manage one or more private funds. The specific information that needs to be reported on this form includes:

1. Basic Identifying Information: This includes the name of the reporting investment adviser, the SEC registration number, the contact information, and the date of the report.

2. Number of Private Funds Managed: The adviser must disclose the total number of private funds it manages.

3. Assets under Management: The adviser needs to report the total value of regulatory assets under management (RAUM) as of the end of the reporting period.

4. Gross Notional Exposure: The adviser must report the gross notional exposure of each private fund it manages.

5. Portfolio Holdings: The adviser needs to disclose the total value of certain categories of investments, such as long and short positions, derivatives positions, and other investments.

6. Performance: The adviser must report the performance information for each private fund, including the rate of return and any other applicable performance metrics.

7. Investor Information: The adviser is required to disclose the total number of beneficial owners of its private funds and specific information about any parallel managed accounts.

8. Other Information: The adviser must provide any additional information required by the SEC, such as updates on material changes to the private funds' offering documents, side letters, or other agreements.

It is important to note that the SEC may periodically update the reporting requirements, and advisers should refer to the most recent instructions provided by the SEC while filling out Form IA 65 5300.

How do I fill out the ia 65 5300 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign form 65 5300 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete iowa form 65 5300 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your 65 5300 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Can I edit iowa 65 5300 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share iowa form 65 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your ia 65 5300 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Iowa Form 65 5300 is not the form you're looking for?Search for another form here.

Keywords relevant to iowa workforce form

Related to iowa 65

If you believe that this page should be taken down, please follow our DMCA take down process

here

.